About Meta

Meta Platforms, Inc. is an American tech company headquartered in Menlo Park, California. Meta owns and operates several prominent social media platforms and communication services, including Facebook, Instagram, WhatsApp, Messenger and Threads. Meta’s mission is to Build the future of human connection and the technology that makes it possible.

headlines

news article

-

Google, Meta lift AI stakes in Asia amid ChatGPT hype

SINGAPORE — Asia’s artificial intelligence race is heating up, with U.S. tech giant Google and rival Meta, operator of Facebook, developing AI tools in a battle for regional clout amid a rush for ChatGPT-type applications.

As an advertising slump clips the earnings of the tech titans, the two companies see AI as a means to shore up services for their user bases in the region, with the Microsoft-backed chatbot ChatGPT capturing the imagination of web surfers through its ability to keenly reply to open-ended queries.

In particular, Google and Meta are leaning into “generative” AI, or systems capable of replying with ideas, text, images or other forms of media in response to human prompts, to build new features into their platforms for customers they serve in Asia.

“We’re really excited about, you know, the Asia-Pacific angle, because this is where the largest base of our users are,” Dan Neary, Meta’s vice president for the region, told Nikkei Asia. “Even at an industry level, this is where the growth is happening — certainly we believe this is where our next billion users are going to come from.”

Meta co-founder Mark Zuckerberg in February said his company was creating a new “top-level product group” focused on generative AI — pulling together teams across the company into one unit in applying the emerging tech to all its offerings, including Facebook and Instagram.

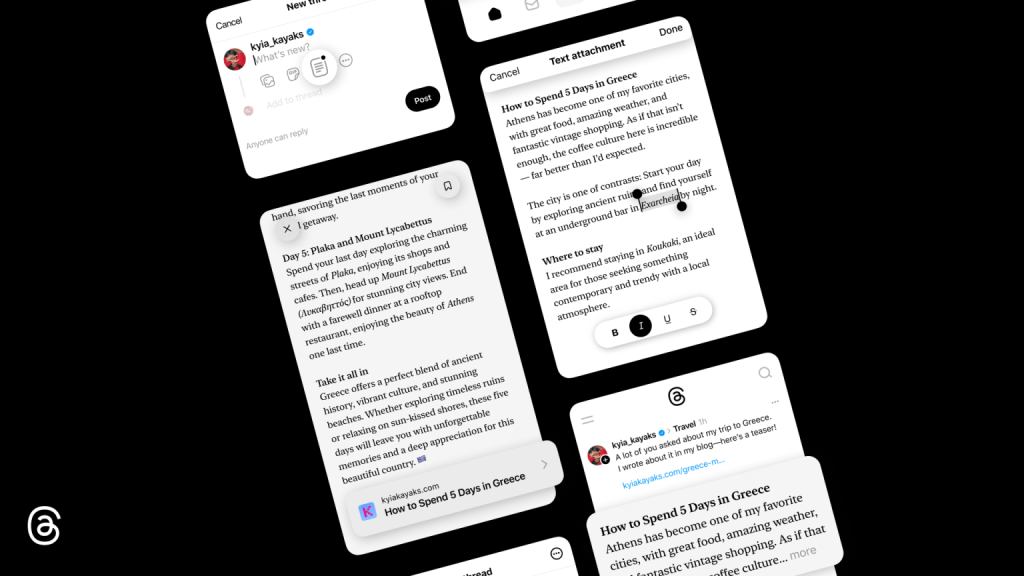

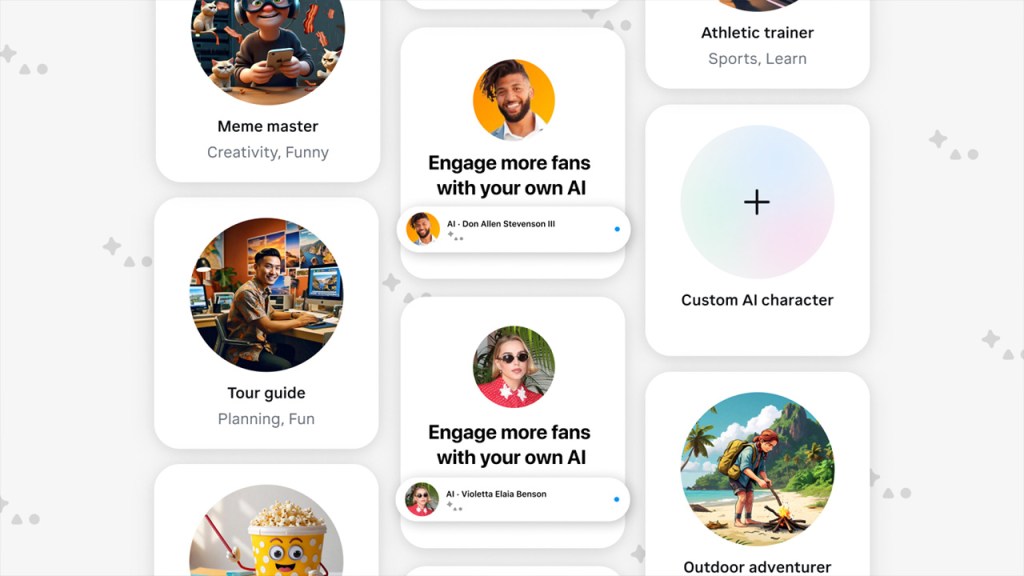

In the short term, the unit will work on building creative and expressive tools for users, and over the longer term the thrust will be on developing so-called “AI personas” that can help people in a variety of ways through Meta’s applications.

“We’re making quite a bit of advancements around AI,” said Neary. “It is absolutely a tenet of where we believe the business is right now.” Meta intends to commercialize its proprietary generative AI by December.

The company sees opportunities for gains with its AI investments enabling increased automation for advertisers to make it easier for them to run campaigns and use Meta’s systems to optimize their performance.

“You’re a small business and you’d like to do an ad but you don’t really know how to develop that,” Neary said of a struggle some companies have with marketing efforts. “You would have the ability in generative AI to say — give me an ad.”

Advertising is a monolith of revenue for Meta. An emphasis on giving advertisers more bang for their buck has taken on increased significance as Meta faces pressure on this front.

The company saw a year-on-year drop of 4.2% in advertising revenue in its latest fourth-quarter earnings last year, with overall revenue during the period declining 4% to $32.17 billion.

As of the end of 2022, it has had to lay off about 11,000 employees working for its platforms segment, which includes apps like Instagram, Messenger and WhatsApp, besides Facebook, as well as its reality labs segment that covers augmented and virtual reality-related output.

Likewise, Sundar Pichai, chief executive officer of Google and its parent, Alphabet, said in January that about 12,000 roles within the group would be reduced. For the U.S. giant and its rival, there are no certainties that their AI investments will compensate for the leaving of creative minds from their fold, some believe.

“While AI technology has the potential to help companies like Google and Meta to grow their user and advertising revenues in Asia, it is still in progress,” Dan Kurtz, co-founder at Las Vegas-based AI-driven marketing outfit Miss Pepper, told Nikkei. “These companies must continue to invest in human creativity and intuition, [and] localize their products and services.”

In February, Alphabet reported a 3.6% year-over-year drop to $59 billion in revenue from Google’s advertising generators, including its search and YouTube segments, for the fourth quarter of last year.

The ad slump has highlighted the cutbacks made by businesses in marketing, as an environment of elevated inflation and interest rates fuels a more conservative stance on corporate spending. Amid this, the rush to generative AI has surfaced as a means for potentially more productive ways to engage consumers.

Last month, Google in Southeast Asia unveiled generative AI functions for its virtual cloud and workspace segments, which will be made available to testers first before it is rolled out to the public.

The company said generative AI support will initially provide foundation models for generating text and images, and over time with audio and video.

In addition, corporates that want to build their own AI-powered chat interfaces and digital assistants can also tap Google’s Generative AI App Builder to help in creating their own chat interfaces with limited technical expertise required, the company said.

“Breakthroughs in generative AI are fundamentally changing how people interact with technology,” noted Thomas Kurian, Google Cloud’s CEO. “Our goal is to continue to be bold and responsible in our approach and partner with others to improve our AI models.”

Still, some are skeptical of the efforts the two tech titans are making on this front, going so far as to argue that it may be more a case of optics than real substance.

“Generative AI [ChatGPT] was introduced in November 2022 only,” Vivek Astvansh, assistant professor at the Department of Marketing at the Kelley School of Business told Nikkei. “These companies may be making statements to receive their share of attention, lest investors infer that lack of statement means lack of interest.”

(Source: Nikkei Asia)